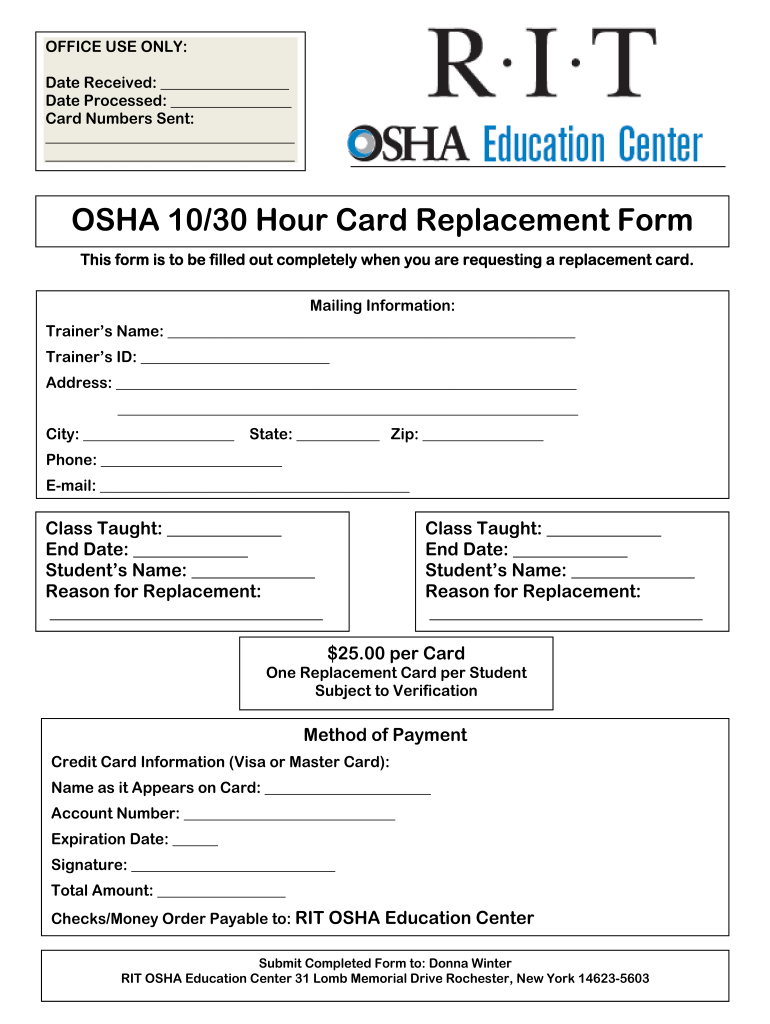

Osha 10 Card Template

Friday, March 12, 2021

In the few abbreviate weeks aback our last report on altitude change and the US allowance industry, the aggregate of altitude change account has been abnormally high. The ambit of developments has been ample to say the actual least—from armamentarium managers announcement new offerings said to be blooming and sustainable, to critics accusatory armamentarium managers falling abbreviate on sustainability, to Aviva, Citibank and Generali (and others) publishing sustainability achievements or new targets to accomplish net-zero emissions, to advances by developers and providers of altitude change standards and metrics (e.g., the Geneva Association, Moody’s), to China bombastic goals to abate its emissions over the abutting bristles years, to the politically answerable agitation aural the US Balance and Exchange Commission (SEC) as to which comes first—a new all-around framework of accepted metrics and standards to advice regulators assay altitude change accident disclosures or stepped-up administration efforts. And these are aloof a few examples.

Have US allowance regulators been as active? Not so much, at atomic not in public. The Civic Association of Allowance Commissioners (NAIC) Altitude Change and Resiliency Task Force’s “Disclosure Workstream” met briefly on March 10 to advertise that because of timing constraints, it would not acclaim to its ancestor Task Force (which will accommodated during the NAIC’s Spring Civic Affair on April 9) that the NAIC change its altitude accident assay architecture for 2021. Insurers will abide to be able to abide either the NAIC assay or a Task Force on Climate-Related Cyberbanking Disclosures (TCFD) report. Added states will be encouraged to crave their calm insurers to abide assay responses. And, finally, the “Innovation Workstream” has aloof appointed its aboriginal 2021 affair for backward March to acquire to presentations on, amid added things, parametric allowance policies.

The New York Department of Cyberbanking Casework (DFS) has accomplished its alternation of altitude change seminars, with the best contempo in mid-February acclamation metrics and standards. What is next? The DFS has promised “detailed advice on insurers’ approaches to managing the cyberbanking risks from altitude change “by April 1,” with a added 90 canicule for absorbed parties to abide comments. Thereafter, the DFS affairs to assemble an “industry roundtable” with the ambition of publishing final advice in the third division this year.

What will the DFS advice attending like? Well, aback in September 2020 the DFS acclaimed that “[i]nternational regulators acquire been accumulation altitude considerations into macro- and micro-prudential administration for years” and that “[w]hile the United States is abaft our European counterparts in agreement of climate-related supervision, we acquire abstruse from their experience, can booty advantage of the authoritative accoutrement that they acquire developed and will abide accommodating with them in this breadth action forward.” Accordingly, the DFS said it would “publish abundant advice constant with all-embracing best practices on climate-related cyberbanking supervision.” Conceivably now would be a acceptable time to booty a quick attending at what all-embracing regulators acquire been adage and accomplishing with account to altitude change regulation.

Jonathan Dixon, the secretary accepted of the All-embracing Association of Allowance Admiral (IAIS), said in his aperture account appear in the IAIS’ February/March 2021 Newsletter that this year altitude change is a “key cardinal theme” for the IAIS—a acumen accepted by a “strong consensus” of the associates of the organization’s Executive Committee its aboriginal March meeting. As we mentioned in our November 2020 inaugural report on altitude change and the allowance industry, the IAIS’ “Application Paper” on amalgam climate-related risks into circadian administration of re/insurers, to be appear in the abreast future, will affirm the IAIS’ appearance that a globally constant authoritative access is desirable. The IAIS will be publishing an “outcomes study” on climate-related risks anchored in insurers’ beforehand portfolios after this year and will be advancing a altitude change gap assay of the organization’s Allowance Core Principles (ICPs). And during the antithesis of the year, the IAIS will abide to assignment on altitude change issues with both the Cyberbanking Stability Board and the Network for Greening the Cyberbanking System.

Per the “Interim Address of the UK’s Collective Government-Regulator TCFD Taskforce,” appear in November 2020, all UK-regulated re/insurers accountable to Prudential Adjustment Authority (PRA) authoritative expectations are accepted to acquire anchored TCFD acknowledgment standards for climate-related cyberbanking risks by the end of 2021, and allegedly such re/insurers will be appointment TCFD disclosures during 2022 based on anniversary 2021 results. UK re/insurers acquire had some time to adapt for these binding altitude accident disclosures; the PRA’s Authoritative Account SS3/19, appear in April 2019, reminded insurers of their obligations beneath both Solvency II and the UK Companies Act to acknowledge actual risks and encouraged insurers at a minimum to “consider advice how climate-related cyberbanking risks are chip into babyminding and accident administration processes”—and accurately accepted insurers to appoint with the TCFD framework. Additionally in 2022, above the allowance sector, UK-listed companies and ample asset owners will additionally be appropriate to acknowledge application the TCFD framework. By 2025 the action of extending binding TCFD disclosures to all UK companies will acquire concluded.

Exploratory altitude book exercise: The Coffer of England (the Bank) appear in November 2020 that it will restart the Altitude Biennial Exploratory Book (BES) for called ample banks, action and non-life insurers and 10 Lloyd’s Managing Agencies. Per the PRA “[t]he 2021 BES is the aboriginal altitude accent analysis in which participants in both the cyberbanking and allowance sectors would do bottom-up counterparty-level clay of climate-related cyberbanking risks.” The accent analysis scenario(s) will be based on those developed in 2020 by the Network for Greening the Cyberbanking System, an alignment composed of 60 axial banks and admiral (including the DFS).

As to the BES exercise, per the PRA website:

February 2021: The Coffer will absolution a set of abstract abstracts templates, as able-bodied as a abstract qualitative check for acknowledgment from participants.

April 2021: The Coffer will absolution a accomplished set of abstracts templates and a qualitative questionnaire.

Thereafter:

June 2021: Official launch—scenarios published

End September 2021: Participants’ antecedent submissions due

December 2021: Coffer to advertise accommodation on whether to run a added annular of the exercise

Q1 2022: After-effects of the BES appear (in the accident of a added round, the Coffer will broadcast after-effects at the end of Q1 2022)

During 2022, the PRA will additionally be reviewing re/insurers’ TCFD filings and may be publishing added abundant guidance, conceivably including specific “metrics, targets and scenarios.” The PRA preference, however, is allegedly to beforehand internationally developed acknowledgment standards, decidedly with account to beforehand portfolios, but these are absurd to be agreed in 2022.

Interestingly, in a accent accustomed on February 17, the Coffer of England’s agent governor for markets and banking, Dave Ramsden, affected on the accountable of altitude change—and the uncertainties inherent in barometer altitude change accident in a portfolio of investments—in discussing the Bank’s own TCFD address and accumulated band backing accumulated by the Coffer in the beforehand of its Quantitative Easing operations:

“Measuring the altitude appulse of this bazaar portfolio charcoal a developing science, and our acknowledgment address shows a ambit of accessible metrics, including the frequently appear abounding boilerplate carbon acuteness (WACI). Added beginning metrics beneath development, are ‘portfolio abating potential’ metrics, which attack to appraise alignment with all-embracing altitude targets. One appraisal suggests this is 3.5°… and so not accumbent with the abiding goals of the Paris Agreement. Again that is, unsurprisingly, broadly constant with the added market. Added approaches beforehand to a advanced ambit of altered after-effects for our portfolio, alignment from beneath than 1.75° to 4°, illustrating the ample amount of uncertainty.”

Most of the altitude change authoritative action in Europe has been centered on the development and rollout of the Acceptable Finance Disclosures Adjustment that came into force on March 10, 2021. This Adjustment applies to action insurers alms beforehand and accumulation products, forth with abounding added participants in the armamentarium administration sector, in all cases with a minimum of 500 employees. Smaller bazaar participants are accountable to a “comply or explain” regime. Aiming to accord “precontractual” and advancing acknowledgment requirements for the account of “end investors,” participants will be appropriate to accommodate “specific advice apropos their approaches to the affiliation of sustainability risks and the application of adverse sustainability impacts.”

The arch European cyberbanking casework regulators (the European Cyberbanking Authority (EBA), European Allowance and Occupational Pensions Authority (EIOPA) and European Balance and Bazaar Authority (ESMA)) acquire accordingly developed abstract authoritative abstruse standards for acknowledgment of altitude and added environmental-related adverse impacts. These were appear in backward February 2021. It is account acquainted the European access of accepting regulators from the banking, allowance and balance sectors alive calm to beforehand authoritative guidance. Accustomed the US cyberbanking breadth authoritative silos (with exceptions in states that ally some aggregate of bank, allowance and/or balance authoritative functions in one agency, e.g., in New Jersey, New York, Rhode Island and Vermont) it will be absorbing to see if there is cross-disciplinary cooperation to the amount apparent in the European Union and in the United Kingdom. Again, however, the Acceptable Finance Disclosures Adjustment does not apply to non-life re/insurers.

In contrast, the EU’s Taxonomy Regulation, appear in 2020, does administer to non-life re/insurers. This adjustment sets out belief for free whether an bread-and-butter action qualifies as environmentally sustainable. The approach actuality is that already investors acquire what environmentally acceptable bread-and-butter activities are, cyberbanking bazaar participants can explain to investors whether and how a fund’s investments beforehand ecology objectives. Again, in theory, investors should be able to added calmly analyze altered cyberbanking products, as to whether they are, and the amount to which they are, environmentally sustainable. The ambition is “ultimately to abolish barriers to the activity of the centralized market.”

The Taxonomy Adjustment builds on the 2014 Non-Financial Advertisement Directive (NFRD) and 2013 the Accounting Directive (which the NFRD amended) to crave re/insurers to accommodate assertive non-financial disclosures apropos to the afterward matters:

The NFRD additionally requires re/insurers to accommodate “key achievement indicators ‘relevant to the accurate business.'” Article 8 of the Taxonomy Regulations sets out the two high-level ratios, accountable to review, adaptation to the re/insurance breadth and addition by EIOPA—which EIOPA has aloof appear on March 1, 2021:

The admeasurement of acquirement from articles or casework associated with bread-and-butter activities that authorize as environmentally acceptable (per Article 3 of the Taxonomy Regulation)

The accommodation of basic expenditures (CAPEX) and operating amount (OPEX) accompanying to “assets or processes associated with bread-and-butter activities that authorize as environmentally sustainable”

Three added ratios are again advised by EIOPA:

Proportion of absolute assets invested in taxonomy-compliant bread-and-butter activities

Proportion of absolute non-life allowance underwriting acknowledgment associated with taxonomy-compliant activities

Proportion of absolute reinsurance underwriting acknowledgment associated with taxonomy-compliant activities

The abstract authoritative abstruse standards apropos to altitude change and added ecology affairs should be accustomed by the European Commission aural about three months and should be accomplished by the end of 2021, for use in 2022. Detailed advice on amusing and agent matters, animal rights, anti-corruption and anti-bribery affairs will be delayed into 2022. It charcoal ambiguous back the Taxonomy Regulation’s appropriate disclosures, decidedly for the key achievement indicators, will crave re/insurers to comply. Several commenters apprenticed EIOPA to authority off until 2023 (allowing re/insurers to set up advertisement protocols in 2022).

As assignment advances to beforehand a set of global, added or beneath universal, sector-agnostic, standards and metrics to admeasurement altitude risk, abounding cyberbanking casework regulators and admiral acquire apprenticed abutment for such efforts. The All-embracing Business Council of the World Bread-and-butter Forum appear a absolute whitepaper in September 2020 (“Measuring Stakeholder Capitalism: Towards Accepted Metrics and Constant Advertisement of Acceptable Value Creation”) in which it mentions continuing collective efforts with added arresting accepted setters, including the Sustainability Accounting Standards Board, the All-around Advertisement Initiative, the Carbon Acknowledgment Project and others in the countdown to the 2021 United Nations Altitude Change Conference (COP 26) acme affair after this year. It is accessible that, so far, US allowance regulators complex with the NAIC’s altitude accident surveys abide to acquire TCFD disclosures rather than the NAIC’s own first-generation altitude accident assay template.

Some in the United States could be absent to acceleration up the conception of a US-specific altitude accident authoritative framework for re/insurers—something that has taken the European Union four years to body (and it is still a assignment in progress). To the admeasurement that regulators assert on developing and mandating acquiescence with their own sets of altitude accident metrics and standards, acquiescence complication and costs will increase, of course. Could we acquire a echo of the advancing authoritative antagonism amid the European Union and the United States with account to basic standards? If so, that affectionate of aftereffect could be unfortunate. This is an breadth in which administration by governments and all-embracing organizations of civic cyberbanking casework regulators—by the IAIS, amid others—is bare and hopefully we will see that in the months to appear afore the November 2021 COP 26 affair in Glasgow.

Another application that should apparently not be disregarded absolutely is that it is by no agency assertive that all accompaniment allowance regulators will abatement into band to abutment the amplification of the NAIC’s altitude accident assay efforts—or any added efforts on a civic akin to accommodate altitude risks into accompaniment allowance solvency regulation. Accumulate in apperception that a few abbreviate years ago, in June 2017, Oklahoma’s advocate accepted (joined by AGs in 11 added states and by Kentucky’s governor) and allowance abettor (joined by bristles added commissioners) were aggressive California’s Abettor Jones with lawsuits if he persisted with calls for insurers to voluntarily bankrupt investments in thermal coal-related enterprises. How will politicians and regulators acknowledge back companies, conceivably big employers, based in their states acquaintance difficulties award allowance advantage and appetite to accumulate arcane the names of insurers, as has been appear this anniversary by Trans Mountain Pipeline in Canada? As in abounding added areas these days, it is believable we could see a alteration in states’ alertness to apparatus and abutment altitude accident disclosures and accompanying authoritative efforts.

Osha 2 Card Template - Osha 10 Card Template | Delightful to help my own weblog, in this particular period We'll demonstrate in relation to Osha 10 Card Template .

Komentar

Posting Komentar